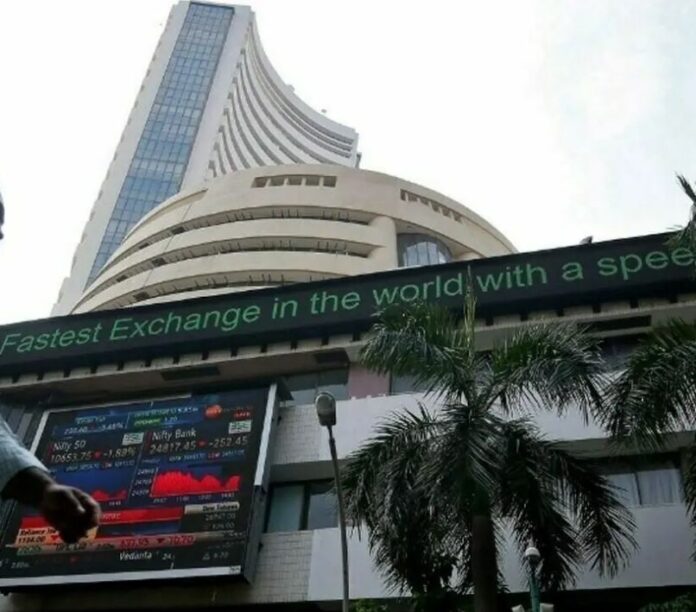

Indian Markets Poised for Cautious Rally Amidst Global Trade Tensions

Indian equity markets are ready for a potential rebound today, aiming to recover from two consecutive days of losses. However, the market sentiment remains subdued due to escalating trade tensions with the U.S. and concerns over new tariffs.

Key Market Indicators at a Glance

As of 7:47 a.m. IST, Gift Nifty futures were trading higher at 24,666.5 points, signaling a positive start for the Nifty 50 compared to its previous close of 24,500.9.

Despite this positive indication, the last two trading sessions have seen the Nifty 50 and Sensex each fall by about 2%. This decline is largely attributed to the looming impact of punitive U.S. tariffs.

U.S. Tariffs and India’s Oil Imports

The U.S. has imposed an additional 25% tariff on Indian goods due to India’s continued purchase of Russian oil, stacking on top of an earlier 25% duty. This move has created significant market anxiety.

Interestingly, reports from dealers suggest that India’s imports of Russian oil are expected to increase in September, a sign of defiance against the U.S. sanctions.

Economic and Corporate Updates to Watch

August has been a challenging month for Indian stocks, with foreign investors selling off $3.3 billion worth of shares—the highest monthly outflow since February. This has left the Sensex down 1.4% and the Nifty down 1.1% for the month.

Other crucial developments on the horizon include:

Economic Growth Data: The much-anticipated economic growth data for the April-June quarter is expected to be released after market hours. A survey of economists indicates a likely slowdown in growth, driven by weak urban demand and sluggish private investment.

GST Council Meeting: The market is also looking forward to next week’s Goods and Services Tax (GST) Council meeting. The council will discuss potential sweeping tax cuts aimed at stimulating the economy amidst the ongoing trade conflict.

Reliance Industries AGM: The oil-to-telecom giant, Reliance Industries, will be a key focus for investors as its annual general meeting (AGM) is scheduled. This event could bring important announcements regarding the company’s future strategies.